Global Rollout Playbook HS Codes Guide

You want to avoid customs delays and costly fees when shipping event fixtures globally. The key is correctly identifying your items' Harmonized System (HS) code. This guide provides the essential knowledge for any agency managing international projects.

Tip: Use this information as your Global rollout playbook. It helps you master documentation and logistics to ensure seamless and predictable event rollouts every time. 🗺️

HS Codes 101: Why They're Critical

Think of an HS code as a universal passport for your products. It tells every customs officer worldwide exactly what you are shipping. Getting this code right is the first step to a smooth customs process. Getting it wrong is expensive.

Decoding the HS Code Structure

The Harmonized System (HS) code is a 6-to-10-digit number that classifies goods. The first six digits are universal across more than 200 countries. You can think of it like a product's address. 🔢

Let's use a custom-built display stand as an example. Here is how you would find its basic code:

- First two digits: These identify the Chapter. Your display stand is a type of furniture, so it falls under Chapter 94.

- Second two digits: These specify the Heading within the chapter. This further narrows down the product category.

- Third two digits: These define the Subheading, providing even more detail.

Countries can add two to four more digits for their own tax and statistical needs. However, the first six digits are your global key.

The High Cost of Incorrect Codes

Using the wrong HS code can turn your event rollout into a logistical nightmare. Customs officials check these codes carefully. A mistake can cost you time and a lot of money. 💸

Here are the risks you face with an incorrect code:

- Shipment Delays: Customs can hold your shipments for inspection, causing you to miss event deadlines.

- Extra Fees: You will face daily storage and demurrage fees while your goods are stuck at the port or warehouse.

- Heavy Fines: Penalties can reach thousands of dollars. You might even be charged two to four times the original duty amount if customs finds you underpaid.

- Seizure of Goods: In serious cases, customs authorities can seize your items completely.

Heads Up: 🚨 The rules are getting stricter. Starting in 2025, the USPS will require a 6-digit HS code for all international shipments. Packages without a correct code may be delayed or returned. This change highlights the growing importance of accurate classification for everyone.

Finding Your Correct HS Code: A 4-Step Process

Finding the right HS code feels like a puzzle, but you can solve it with a clear method. This four-step process breaks down the task into manageable actions. Follow these steps to classify your event materials accurately and confidently.

Step 1: Gather Product Details

You cannot find the right code without knowing your product inside and out. Customs officials need specific details to verify your classification. Before you start searching, gather all the essential information. This information is your foundation.

You need to answer three key questions about every item you ship:

- What is it made of? List all materials. For a display stand, this could be aluminum, acrylic, and vinyl. Note the primary material by weight.

- What does it do? Describe its main function. Is it a light-up sign for branding? A modular wall for booth construction? A stand for holding brochures?

- What is its form? Note the physical state. Is it fully assembled, or is it shipped in parts? Are there liquids or powders involved?

The intended use of your item is critical. A display built for a single, temporary trade show may get a different code than one for a permanent showroom. For example, goods for temporary exhibition can sometimes use special codes like

9801if they will be re-exported. This can impact the duties you owe.

Step 2: Use Official Search Tools

Once you have your product details, you can begin your search. Do not rely on unofficial charts or general web searches. Always use official government resources to ensure accuracy. These tools are the most reliable sources.

Start with these official websites:

- Your Country's Tariff Database: Most countries have an online tool. For the United States, you can use the official Harmonized Tariff Schedule (HTS) search tool provided by the U.S. International Trade Commission.

- World Customs Organization (WCO): The WCO offers the HS Nomenclature through its online database, WCO Trade Tools. This is the global source text for the first six digits of the code. 💻

Type in keywords describing your product's function and material. For example, search "aluminum display stand" or "printed vinyl banner." The search results will give you potential chapters and headings to investigate further.

Step 3: Navigate Chapters and Headings

The HS system is a giant library with a logical structure. Your search results will point you to a specific Chapter (the first two digits). From there, you will navigate to the correct Heading (digits 3-4) and Subheading (digits 5-6).

What if your product has multiple materials, like a wooden frame with a fabric graphic? The HS system has rules for this.

Pro Tip: For products made of mixed materials, you must find what gives the item its "essential character."

- For textiles, you generally classify the item based on the material that has the greatest weight.

- If no material predominates by weight, you use the heading that appears last in numerical order among those that could apply.

- If your item is a "set" (e.g., a kit with separate parts meant to be mixed or used together), you classify it under the heading for the final, combined product.

Read the chapter and heading notes carefully. These legal notes provide specific definitions and tell you what is included or excluded. This step confirms you have chosen the correct classification.

Step 4: Request a Binding Ruling

What if you are still unsure? Your product might be new, unique, or complex. In this situation, you can get a definitive answer and eliminate all guesswork. You can ask customs authorities for a "binding ruling."

A binding ruling is an official, legally binding decision on your product's HS code. In the U.S., you can submit a request electronically to U.S. Customs and Border Protection (CBP) through their eRulings program. Your request goes to the National Commodity Specialist Division (NCSD), which typically issues a ruling within 30 days.

Your request must include:

- A complete description of the product.

- Details on material composition.

- Information on its intended use.

- Photographs, drawings, or even samples.

✅ The Power of a Binding Ruling A binding ruling gives you complete certainty. It is valid for a set period (in the EU, for example, it is valid across all member states). This protects you from classification changes and allows for precise budgeting on future shipments of the same item. It transforms a complex process into a predictable one.

Essential Shipping Documents Checklist

Your correct HS code is only half the battle. You also need the right paperwork to back it up. Customs officials review your documents as closely as they check your codes. This checklist covers the essential documents you need for a smooth global rollout. 📄

The Commercial Invoice

The commercial invoice is the single most important shipping document. It is the primary record of the transaction for customs. You must fill it out completely and accurately. An incomplete or incorrect invoice is a guaranteed way to cause delays.

Every commercial invoice must include specific data fields. Think of this as your master checklist for every shipment:

- Shipper & Receiver Details: Your business name, address, and tax ID, along with the same information for the consignee (receiver).

- Dates & Numbers: A unique invoice number, the date of issue, and any relevant purchase order numbers.

- Product Information: A detailed description of each item, its quantity, and its correct 6-digit HS code.

- Value & Currency: The unit price and total value for each item, clearly stating the currency (e.g., USD, EUR).

- Shipping & Packing Details: The shipping method, gross and net weight, number of packages, and Incoterms (e.g., EXW, DDP) that define who is responsible for the shipment.

- Country of Origin: The country where your goods were manufactured.

A common challenge for event materials is declaring value for items that are not for sale, like a promotional display. You cannot declare a value of $0. Customs requires a "fair market value," which is the price the item would sell for.

For items with no sale price, you can state on the invoice: “Samples with no commercial value; value for customs purposes only: $XXXX.” This shows you are assigning a realistic value for duty calculation, which prevents customs from holding your shipment to determine the value themselves.

ATA Carnet vs. Standard Entry

When you ship items for a temporary event and plan to bring them back, you have two main options: an ATA Carnet or a standard customs entry. The ATA Carnet acts like a passport for your goods. It simplifies customs procedures for temporary imports into about 80 member countries. ✈️

Choosing the right option depends on your needs. This table breaks down the key differences:

| Feature | ATA Carnet | Standard Customs Entry (TIB) |

|---|---|---|

| Cost & Taxes | Eliminates duties and taxes for goods you re-export. | You pay duties and taxes upfront and request a refund later. |

| Procedure | Uses one document for multiple trips and countries. | Requires new paperwork and bonds for each import. |

| Flexibility | Valid for one year with unlimited entries. | Usually covers only a single import. |

| Guarantee | Requires one security bond (typically 40% of the goods' value). | Often requires a new cash deposit or bond at each border. |

| Best For | Multi-country event tours or frequent temporary exports. | Shipments to non-Carnet countries or goods that will be altered. |

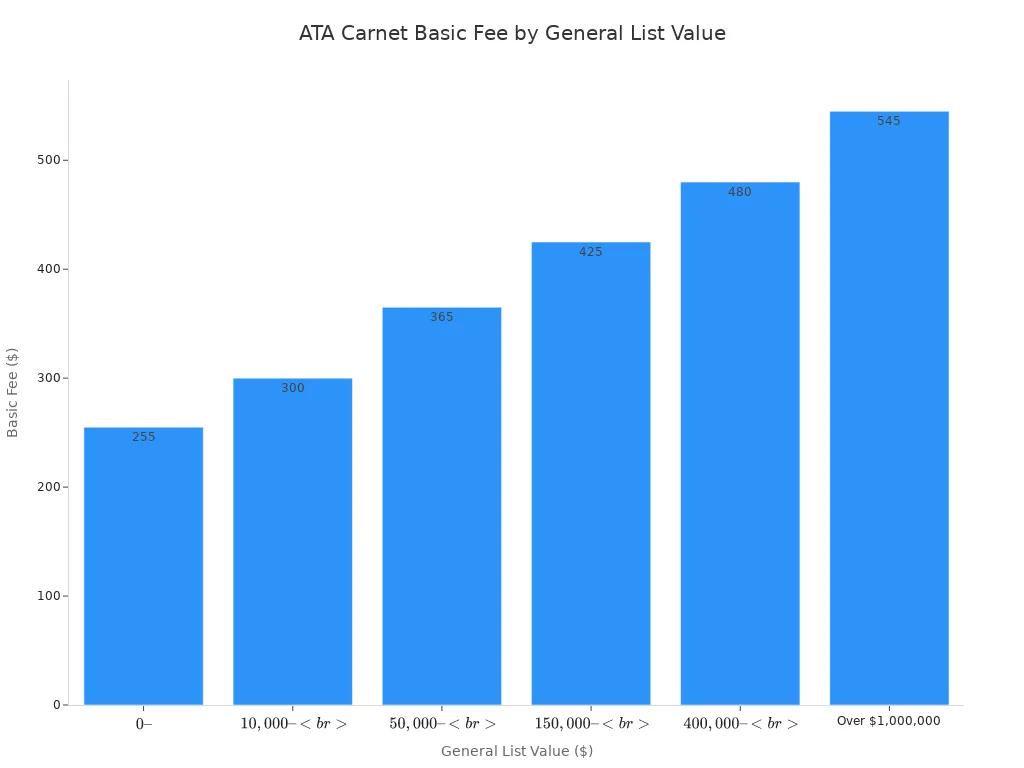

The cost of an ATA Carnet depends on the total value of your goods. The basic fee increases with the value of your shipment.

You must also post a security bond, which is usually 40% of the total value of the items listed. This bond is refunded after you close the Carnet correctly. Note that vehicles often require a higher bond of 100% to 150% of their value.

Supporting Documents

Depending on your goods and destination, you may need extra documents. Two common ones are the Fumigation Certificate and the Shipper's Letter of Instruction.

1. Fumigation Certificate If you ship items using any raw wood packaging, like pallets, crates, or drums, you will likely need a Fumigation Certificate. This document proves that the wood has been treated to eliminate pests and diseases. It is required by many countries to protect their local ecosystems. Items that often require this include:

- Wooden crates and pallets

- Raw wood displays or furniture

- Textiles like wool or cotton that could harbor pests

2. Shipper's Letter of Instruction (SLI) The SLI is a document you give to your freight forwarder. It provides all the information and authority they need to handle your shipment. It ensures everyone is on the same page and helps your forwarder prepare the Bill of Lading and file export declarations correctly. Your SLI should include key details like shipper/receiver information, a description of the goods, their weight and dimensions, and the HS codes.

Your Global Rollout Playbook: Pro Tips for Success

You can turn complex shipping into a simple, repeatable process. These professional tips will upgrade your global rollout playbook from a list of tasks to a true strategy. Follow these steps to save time, reduce costs, and execute flawless events.

Partner with an Event Logistics Expert

You do not have to manage global shipping alone. An expert freight forwarder specializing in events is your most valuable partner. They handle the details so you can focus on the event itself. A good partner offers more than just transport.

Look for an expert who provides:

- Customs clearance and document creation

- Time-critical shipment management

- On-site support with equipment like forklifts and cranes

- Secure storage and professional repacking services

Create a Master Item List

Consistency is key for a successful global rollout playbook. A master item list is your single source of truth for every item you ship. This document helps you, your forwarder, and customs officials stay aligned. It ensures every shipment uses the same descriptions and codes.

Your list should include these details for each item:

- Item name and a detailed description

- Bill of materials (BOM)

- Country of origin

- Purchase cost or fair market value

- HS code

Leverage Free Trade Agreements

Free Trade Agreements (FTAs) can lower or eliminate duties on your goods. If you are shipping between member countries, you can save significant money. For example, the USMCA simplifies trade between the United States, Mexico, and Canada. The CETA agreement does the same for trade between Canada and the European Union. To claim these benefits, you must provide a Certificate of Origin to prove your goods qualify.

Understand De Minimis Values

De minimis value is the price threshold below which a shipment can enter a country without duties or taxes. This is perfect for small, low-value shipments. Knowing these values helps you plan. This table shows the thresholds for major event destinations.

| Region | De Minimis Threshold |

|---|---|

| United States | $800 USD |

| European Union | €150 for duties (VAT is often still due) |

| Canada | CAD $20 |

Using these tips will strengthen your global rollout playbook and make international events more predictable.

You now have the foundation for a successful global event rollout. Accurate HS codes and correct documents, like a Commercial Invoice or ATA Carnet, are your keys to avoiding delays. Using a master item list and an expert partner transforms this process into a repeatable system. This strategic planning helps you manage your budget and execute on time. Your Global rollout playbook empowers you to take control of logistics, ensuring every event is a predictable success. ✅

FAQ

What if my event item is not for sale?

You must still declare a fair market value. You cannot use $0. State on your commercial invoice: "Value for customs purposes only." This shows customs you assigned a realistic value for duty calculations and helps avoid delays.

How long does it take to get an HS code?

You find the HS code yourself using official search tools. This process can be quick. For a complex item, you can request a binding ruling from customs. This provides a legal, definitive answer, which usually takes about 30 days.

Can I reuse an ATA Carnet for multiple events?

Yes. An ATA Carnet is valid for one full year. You can use it for unlimited entries into member countries during that period. This makes it a cost-effective tool for multi-stop event tours or frequent temporary shipments. ✈️

Do I need an HS code for every single part in a kit?

No. You classify a kit or set under a single HS code. This code should represent the item that gives the set its "essential character" or main function. This rule simplifies your documentation for items meant to be used together.