Cost drivers explained for 2025 prices

Customers often face a confusing reality. Seemingly identical retail displays carry wildly different prices. This creates budgeting challenges for 2025.

Planners wonder why one display stand costs $500 while a similar one is $5,000.

A complex pricing strategy is the reason. This pricing strategy includes a specific markup. The retail markup directly impacts final pricing for customers. A store's markup strategy sets its pricing. This markup changes the final pricing. The markup is key. Understanding the markup helps explain the costs. Future retail prices are also uncertain. Projections for the global retail display market show this volatility:

- One forecast suggests a 2.26% growth rate from 2025 to 2035.

- Another predicts a -24.74% decline for the same period.

These are the cost drivers explained.

Material Costs: The Foundation of Display Pricing

The choice of material is often the most significant factor in display pricing. It sets the baseline for all subsequent costs. A grocery store's pricing strategy must account for this initial value. The final markup reflects this foundational choice.

Premium Metals and Woods

High-end materials like stainless steel and solid oak signal luxury and durability. Brands use them to convey a premium value. This choice elevates the product's perceived value. However, these materials carry a high initial pricing. A grocery chain might use these for a high-margin section. The pricing reflects this quality, and the markup is adjusted accordingly. The final pricing for the customer shows this investment. A grocery store's markup on these displays is often higher.

MDF and Particle Board

Medium-Density Fiberboard (MDF) and particle board offer a cost-effective alternative to solid wood. They provide good value for many applications.

- MDF is denser and heavier, which increases shipping costs.

- Particle board is lighter, making it easier to handle and cheaper to transport. A grocery store considers this shipping factor in its overall pricing. The markup on these items provides good value. The final pricing is more accessible for temporary or large-scale grocery promotions. The markup strategy delivers value.

Plastics, Acrylics, and PVC

Plastics offer great versatility in display design. Their pricing varies significantly, impacting the final markup. Acrylic provides superior clarity and durability, justifying its higher pricing. PVC is a budget-friendly option, but its recycling rate is only 9.7%. A grocery store must weigh this environmental factor. The value of acrylic often outweighs its initial pricing over time.

| Material | Base Price per Square Foot |

|---|---|

| Acrylic | ~$15 |

| PVC | ~$5 |

| Premium Acrylic | Upwards of $50 |

This pricing difference directly influences a grocery store's markup. The chosen material adds value to the display.

Corrugate and Cardboard

For temporary or promotional displays, corrugate is the king of value. This material keeps initial pricing extremely low. A grocery store can deploy many of these displays without a large budget. The low pricing allows for a flexible markup. This strategy is perfect for seasonal items in a grocery aisle. The value is in its disposability and low cost.

The Impact of Finishes and Coatings

Finishes like powder coating, laminates, and veneers add the final touch. They protect the display and enhance its aesthetic value. This extra step adds to the pricing. A simple finish has a small markup. A complex, multi-layer finish will have a higher markup. This final touch can significantly increase the perceived value for a grocery shopper, justifying the pricing.

Manufacturing and Design Complexity

Beyond materials, the design and manufacturing process adds significant costs to a display's final pricing. A grocery store’s markup strategy must account for these production variables. The complexity of a display directly impacts its base pricing. This, in turn, shapes the final grocery markup.

Custom vs. Modular Designs

Brands choose between custom and modular designs. Modular displays use standard parts. This approach lowers the initial pricing and offers good value. Custom designs are unique and built from scratch. They create a strong brand statement for a grocery aisle. This uniqueness comes with higher development pricing. A grocery store applies a different markup to custom units. The markup reflects the higher investment and perceived value.

Labor for Intricate Assembly

Intricate designs require more hands-on assembly. This skilled labor increases the unit pricing. For example, temporary workers for retail display assembly can cost $17.45 per hour per worker. A display with many small parts or complex wiring will have a higher labor pricing. A grocery manager knows this added pricing contributes to the final markup. The goal is to ensure the display's visual appeal provides enough value to justify the pricing. A grocery chain must balance this pricing with its budget.

Note: The more complex the assembly, the higher the labor pricing. This directly influences the final grocery markup and the product's perceived value.

Structural Engineering for Durability

A display must be safe and durable. Structural engineering ensures a display can hold product weight and withstand store traffic. This engineering adds to the upfront pricing. However, it provides immense long-term value by preventing breakage and extending the display's life. A grocery store prefers durable displays. The store's markup on a well-engineered unit reflects its superior quality and longevity. This smart pricing delivers better value over time.

Upfront Tooling and Prototyping

Creating custom components often requires special tools, like injection molds for plastic parts. The fabrication of the mold is a major part of the total pricing. These upfront investments can be substantial.

- Simple, single-cavity molds might cost a few thousand dollars.

- Complex, multi-cavity molds can cost from $25,000 to $50,000 or more.

This tooling pricing is spread across the production run. A larger order reduces the per-unit pricing. A grocery brand must factor this tooling pricing into its budget. The final markup must help recover this initial investment while delivering value.

| Part Size | Design Complexity | Mold Cost Range |

|---|---|---|

| Small | Simple | $10,000 – $20,000 |

| Small | Complex | $20,000 – $40,000 |

| Large | Simple | $30,000 – $100,000 |

Technology Integration Costs

Technology transforms a static display into an interactive experience. This transformation adds a significant layer to the final pricing. Each technological component carries its own cost, which directly influences the required markup. A smart pricing strategy accounts for these advanced features.

Static vs. Programmable LED Lighting

Lighting choices greatly affect a display's cost and appeal. Static LED lights offer a simple, low-cost way to illuminate a product. Their pricing is minimal. Programmable LEDs, however, allow for dynamic color changes and animations. This feature creates a more engaging experience for a grocery shopper. The advanced technology comes with higher pricing. Therefore, a display with programmable lights will carry a higher markup to reflect its enhanced value. The final pricing is a balance of impact and budget.

Interactive Digital Screens

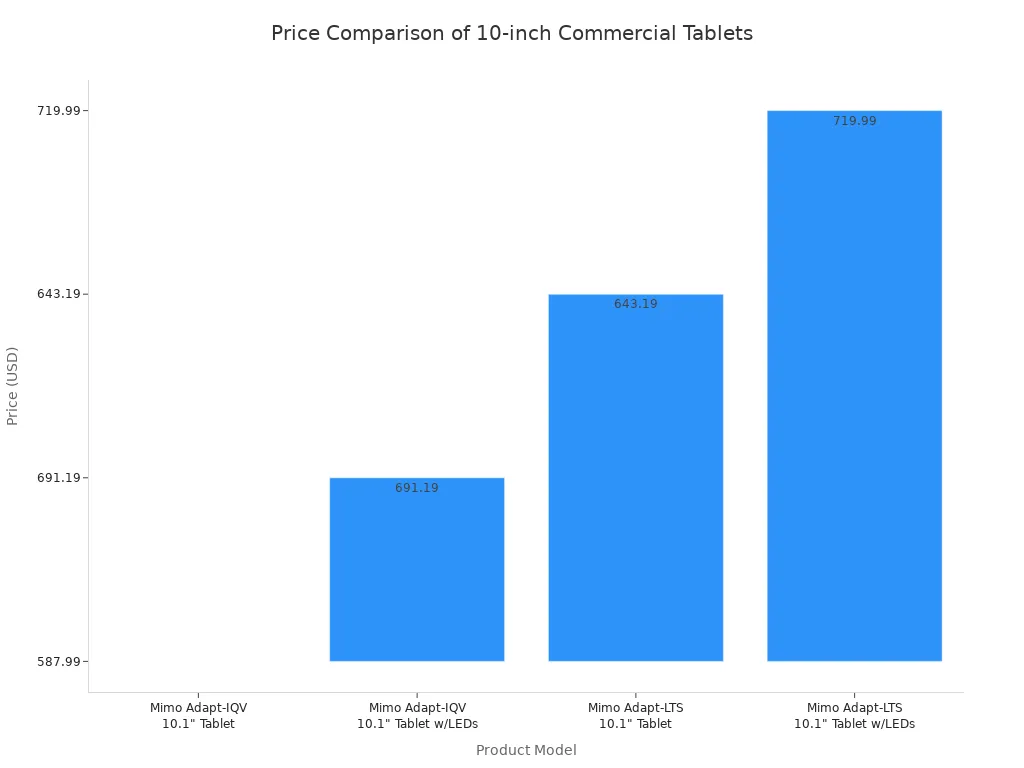

Digital screens turn a passive display into an active sales tool. They can show videos, product details, and promotions. This interactivity justifies a much higher pricing. Commercial-grade tablets are a popular choice for these integrations. Their costs can vary based on features like integrated light bars or processor power.

This upfront hardware pricing requires a substantial markup. A grocery brand must see a clear return on this investment, so the markup is essential. The pricing reflects the screen's ability to capture attention and drive sales. The markup ensures profitability.

Analytics Sensors and Data

Modern displays can include sensors to track customer behavior. These sensors measure foot traffic or how long shoppers look at a product. This data is incredibly valuable for optimizing layouts and promotions.

This technology often involves a recurring subscription pricing, not just a one-time hardware cost. Monthly fees can range from $20 to $45 per device, depending on the data's complexity.

This ongoing pricing must be built into the product's overall markup strategy. The value of the data justifies the continuous pricing. A grocery store uses this information to make smarter decisions, so the markup is a necessary part of the pricing.

Power and Wiring Infrastructure

A powered display needs a reliable energy source. The choice between a hardwired or battery-powered solution affects the total pricing.

- Hardwired solutions have low material costs but can require expensive professional installation.

- Wireless, battery-powered solutions avoid high installation fees but may have higher hardware pricing for long-range gateways.

This infrastructure decision is a critical part of the initial pricing. A grocery store must consider these installation costs. The final markup on the display must cover this foundational expense. The chosen power solution directly impacts the display's final pricing and the necessary markup.

Retail Pricing Strategy and Partner Agreements

The manufacturer sets a base cost, but the retail store has the final say on the shelf price. A complex retail pricing strategy determines what customers ultimately pay. This strategy considers supplier agreements, operating costs, and the store's own profit goals. A grocery chain's retail pricing strategy will differ greatly from a small shop's strategy. Understanding this retail pricing strategy is key for brands. The retail pricing strategy dictates the final pricing for customers. A good retail pricing strategy balances profit with value for customers.

How Supplier Pricing Varies by Retailer

Suppliers often use a tiered pricing model. This strategy means a large retail chain gets better prices than a small, independent store. A grocery business ordering hundreds of units receives a lower wholesale pricing. This tiered pricing strategy directly impacts the final markup for customers. For example, a supplier’s pricing strategy might look like this:

- Bronze Tier (1–49 units): Priced at $9 per unit.

- Silver Tier (50–199 units): Priced at $8.50 per unit.

- Gold Tier (200+ units): Priced at $8 per unit. This retail pricing strategy gives an advantage to a large grocery operation.

Markups and Store Operating Costs

A store’s markup covers its operating costs like rent, utilities, and employee salaries. The final markup also includes the store's profit margin.

A convenience store has high overhead per item, leading to a higher average markup. A large grocery warehouse uses a low markup strategy, relying on high sales volume. This retail pricing strategy passes savings to customers. The average markup is a core part of any retail pricing strategy. A value-based pricing approach sets the markup according to perceived worth. This value-based pricing strategy helps a retail store maximize revenue. The markup is a critical part of the pricing. The retail pricing strategy must account for this markup.

The Role of Volume and Exclusivity Deals

Volume is a powerful negotiating tool. A national grocery chain can commit to a large order, securing a much lower unit pricing. This is a common retail pricing strategy. Manufacturers often offer significant discounts for bulk purchases. For instance, wholesale buyers ordering over 1,000 units might receive a 15% discount on their pricing. This volume-based pricing strategy allows the retail giant to apply a competitive markup. Exclusivity deals also influence pricing, giving one retail partner unique access and better prices. This strategy benefits both the brand and the grocery store, creating value for customers. This value-based pricing strategy is effective.

State Taxes and Fees on Specific Products

The final cost for customers also includes external factors. State and local governments may impose taxes or fees on certain goods. This additional pricing is outside the control of the retail store or the brand. The retail business must collect these taxes from customers. This factor adds another layer to the final pricing. The retail pricing strategy must communicate this added cost clearly to customers. A value-based pricing strategy cannot ignore these mandatory fees. The final markup must be applied before these taxes.

Logistics, Scale, and Rollout

The journey from the factory to the store floor introduces another set of costs. Logistics and rollout strategies significantly influence the final pricing. A brand's approach to production scale and installation directly impacts the necessary markup. This final pricing stage is critical for budget planning.

Economies of Scale in Production

Producing displays in large quantities creates economies of scale. Manufacturers can lower the per-unit pricing when they produce thousands of units instead of just a few. This volume discount reduces the base cost. A lower base pricing allows for a more flexible markup. This strategy helps brands manage their overall budget. The final pricing reflects these production efficiencies. A smart markup strategy leverages this lower pricing.

Shipping and Freight Costs

Moving displays from the factory to retail locations adds to the total pricing. Costs depend on weight, size, and distance. A heavy, fully assembled display costs more to ship than a lightweight, flat-packed one. This freight expense is a key part of the final pricing. The markup must cover these transportation costs. Brands must consider this shipping pricing when designing their displays. A higher shipping cost requires a higher markup.

Kitting and Pre-Assembly Services

Kitting involves grouping all necessary display components into one package for easy setup. This service simplifies the process for store employees. Pre-assembly goes a step further by building parts of the display beforehand. These services add labor costs to the initial pricing. However, they save time and reduce installation errors at the store. The markup on a kitted display reflects this added value. This pricing strategy can improve rollout speed.

On-Site Installation and Maintenance

Professional installation ensures displays are set up correctly and safely. This service has its own pricing structure, which affects the total cost. The final markup must account for this expense.

On-site installation rates can vary widely. Digital signage setup might cost $295 for the first hour. Union labor in big cities can push rates to $150–$200 per hour.

Ongoing maintenance also adds to the long-term pricing. Annual contracts can range from $50 to $500 per display. This recurring pricing ensures the display remains functional. The initial markup should consider these future costs.

These cost drivers explained the final retail pricing. A retail strategy sets the markup for customers. The retail pricing strategy determines the markup customers see. This retail pricing strategy impacts the final markup for customers. These cost drivers explained the retail pricing. A retail strategy uses a specific markup. This pricing strategy helps customers. The retail pricing strategy sets the final prices. The markup affects customers. These cost drivers explained the retail pricing. A good retail strategy manages the markup. This pricing strategy benefits customers. The final prices reflect the markup. These cost drivers explained the retail pricing. A smart strategy controls the markup. This pricing strategy helps customers. The final prices show the markup for customers.

FAQ

Why do material choices impact pricing so much?

Material selection sets the base cost for any display. Premium materials have a higher initial pricing. This foundational pricing directly influences all subsequent markups. A brand's choice establishes the product's perceived value and final pricing. This is a key part of the overall pricing strategy.

How can a brand lower its display pricing?

Brands can reduce costs in several ways.

- Choosing cost-effective materials like MDF or corrugate.

- Using modular designs instead of custom ones.

- Placing large volume orders to lower the unit pricing. This strategic approach to pricing helps manage budgets effectively.

Does technology always increase the pricing?

Yes, technology integration adds to the total cost. Interactive screens and analytics sensors have a high initial pricing. Even simple LED lighting affects the pricing. This advanced functionality requires a higher budget compared to static, non-tech displays. The final pricing reflects this added value.

Who really decides the final pricing?

The retail store determines the final shelf price. While manufacturers set a base cost, the retailer applies its own markup. This retail pricing strategy covers operating expenses and profit goals. The store has the ultimate control over the customer-facing pricing.